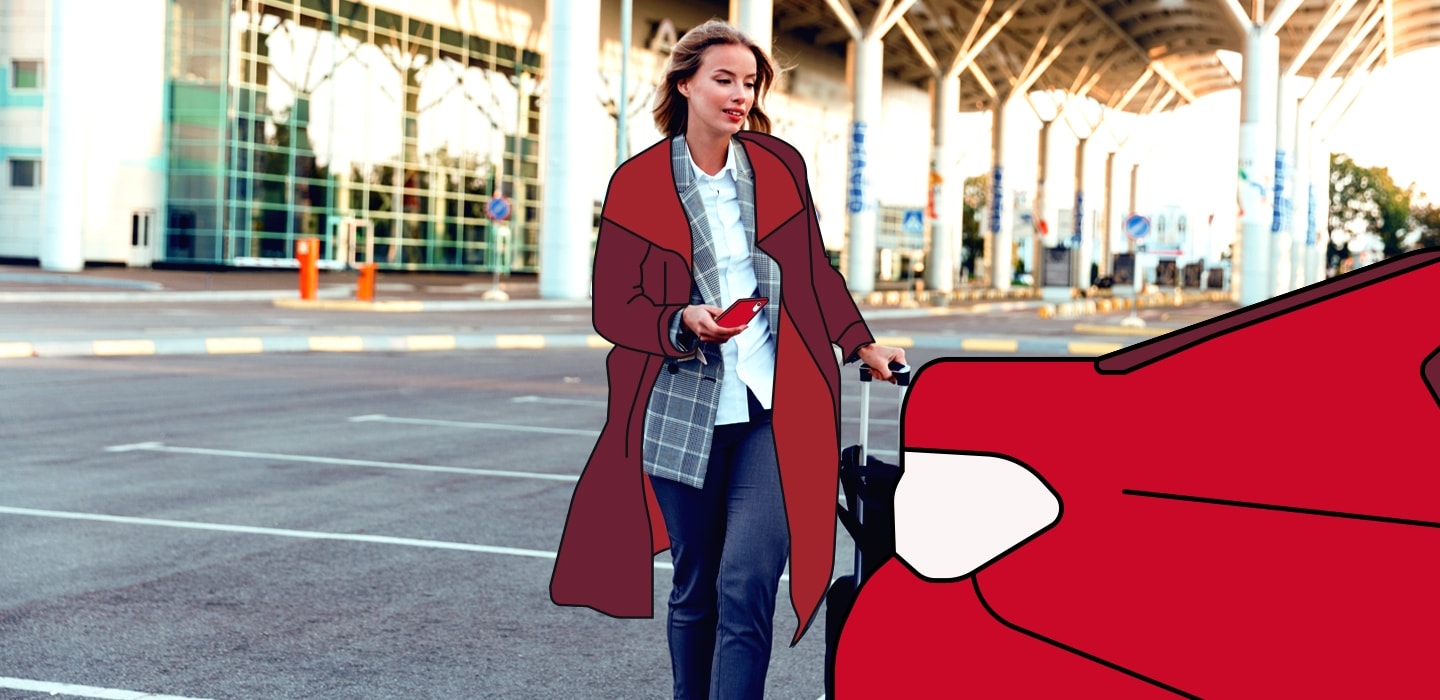

Work trips made easy

Your employees book fast, safe and reliable taxis in seconds with the FREENOW app.

Meanwhile, you get a company-wide view of trips, automated expensing, simplified payments, and one monthly invoice — all in one platform.

Less admin, lower costs, zero hassle.

Trusted by +15,000 companies

Taxi management platform that saves you hours — and euros

- Say goodbye to expensingGet detailed monthly statements, integrate with SAP Concur or Amadeus Cytric — no more manual expense claims or wasted time.

Simplified paymentsCover all business rides with a single monthly invoice, AMEX BTA or a company card, or let employees use their own cards. You decide what works best.

Simplified paymentsCover all business rides with a single monthly invoice, AMEX BTA or a company card, or let employees use their own cards. You decide what works best.- Stay in control, cut costsSet travel policies, spending limits, and cost centres by team. Then monitor trips in real time. Stay on budget, effortlessly.

- Reliable & fast business taxisArrive on time, every time. Your employees can get from their couch to a taxi in 4 minutes on average. Plus, with our Airport Prebook Promise, rest assured taxis will arrive on time — guaranteed.

- Keep your employees safeDuty of care is top of mind at FREENOW for Business. That's why we offer safety features like 'Share Your Trip' & verify all drivers — including the driver's name, picture, car & rating before they arrive.

- Reduce your carbon footprintMeet your sustainability targets with our zero-emission vehicles and power your CSR strategy with data from our CO2 reports. Click here to view our SBTi commitment.Discover more

- Your data is safe

We're ISO 27001 certified. That means that your data is safe with us. After all, your security and safety is our priority.

- Say goodbye to expensingGet detailed monthly statements, integrate with SAP Concur or Amadeus Cytric — no more manual expense claims or wasted time.

Simplified paymentsCover all business rides with a single monthly invoice, AMEX BTA or a company card, or let employees use their own cards. You decide what works best.

Simplified paymentsCover all business rides with a single monthly invoice, AMEX BTA or a company card, or let employees use their own cards. You decide what works best.- Stay in control, cut costsSet travel policies, spending limits, and cost centres by team. Then monitor trips in real time. Stay on budget, effortlessly.

- Reliable & fast business taxisArrive on time, every time. Your employees can get from their couch to a taxi in 4 minutes on average. Plus, with our Airport Prebook Promise, rest assured taxis will arrive on time — guaranteed.

- Keep your employees safeDuty of care is top of mind at FREENOW for Business. That's why we offer safety features like 'Share Your Trip' & verify all drivers — including the driver's name, picture, car & rating before they arrive.

- Reduce your carbon footprintMeet your sustainability targets with our zero-emission vehicles and power your CSR strategy with data from our CO2 reports. Click here to view our SBTi commitment.Discover more

- Your data is safe

We're ISO 27001 certified. That means that your data is safe with us. After all, your security and safety is our priority.

How FREENOW for Business works

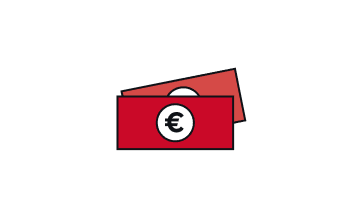

Employees book fast, reliable & safe taxis

.png&w=3840&q=75)

You get a company-wide view of trips

Discover our platform

Moving your employees through the city

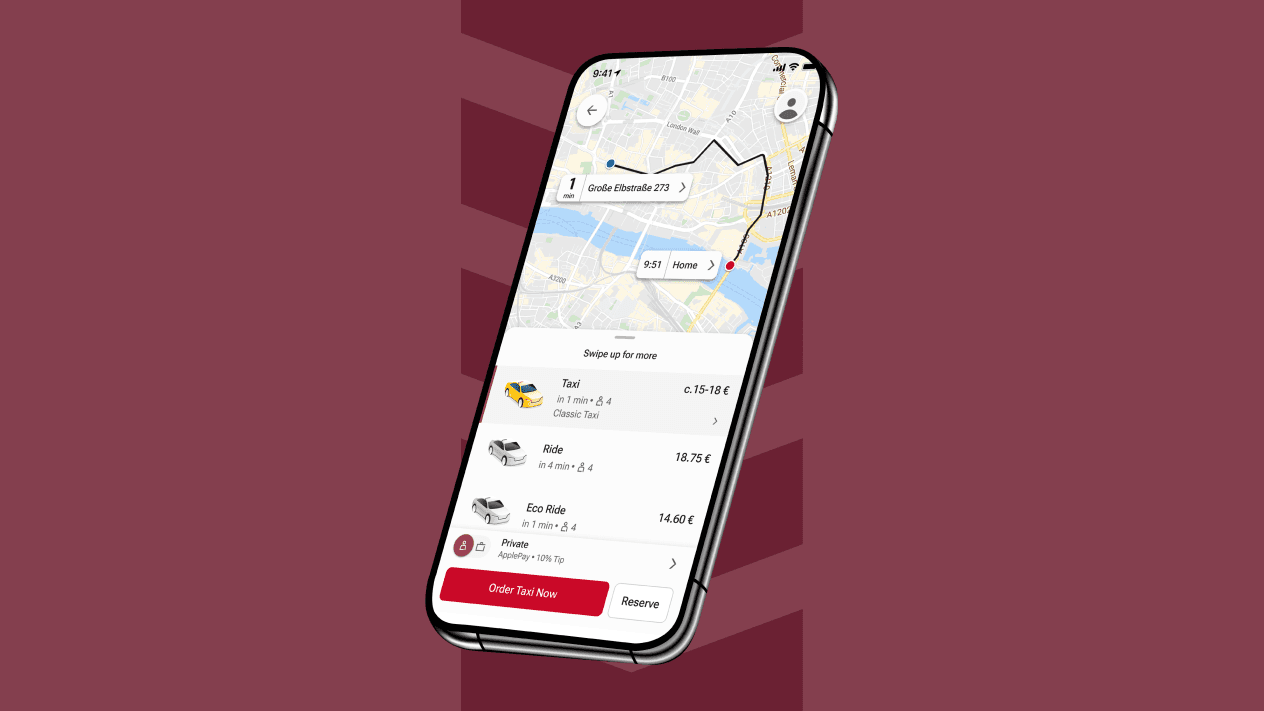

Airport transport & transfersGet your employees to the airport on time. Book in advance or on demand for any size team.Learn more

Airport transport & transfersGet your employees to the airport on time. Book in advance or on demand for any size team.Learn more Business trips & meetingsOur safe, reliable and comfortable service allows your employees to travel stress-free — no matter where they're headed.Learn more

Business trips & meetingsOur safe, reliable and comfortable service allows your employees to travel stress-free — no matter where they're headed.Learn more After-hours travelWe offer an alternative to company cars by bringing your teams safely from their home to the workplace and back.Learn more

After-hours travelWe offer an alternative to company cars by bringing your teams safely from their home to the workplace and back.Learn more Client & guest bookingWith our Web Booker, you can arrange trips for clients and guests without them needing to download the app.Learn more

Client & guest bookingWith our Web Booker, you can arrange trips for clients and guests without them needing to download the app.Learn more Company eventsEnsure your teams get home safely after your company party with FREENOW's fleet of reliable taxis and PHVs.Learn more

Company eventsEnsure your teams get home safely after your company party with FREENOW's fleet of reliable taxis and PHVs.Learn more

Airport transport & transfersGet your employees to the airport on time. Book in advance or on demand for any size team.Learn more

Airport transport & transfersGet your employees to the airport on time. Book in advance or on demand for any size team.Learn more Business trips & meetingsOur safe, reliable and comfortable service allows your employees to travel stress-free — no matter where they're headed.Learn more

Business trips & meetingsOur safe, reliable and comfortable service allows your employees to travel stress-free — no matter where they're headed.Learn more After-hours travelWe offer an alternative to company cars by bringing your teams safely from their home to the workplace and back.Learn more

After-hours travelWe offer an alternative to company cars by bringing your teams safely from their home to the workplace and back.Learn more Client & guest bookingWith our Web Booker, you can arrange trips for clients and guests without them needing to download the app.Learn more

Client & guest bookingWith our Web Booker, you can arrange trips for clients and guests without them needing to download the app.Learn more Company eventsEnsure your teams get home safely after your company party with FREENOW's fleet of reliable taxis and PHVs.Learn more

Company eventsEnsure your teams get home safely after your company party with FREENOW's fleet of reliable taxis and PHVs.Learn more

Your employees choose their travel method

- TaxiBook a back seat and let top-rated local drivers take you from A to B. Your go-to for stress-free journeys.

- Electric taxi

The same safe, reliable taxis but with electric engines.

Priority taxi

Priority taxiYour classic taxi, designed for faster pickups when every second counts for your business.

- TaxiBook a back seat and let top-rated local drivers take you from A to B. Your go-to for stress-free journeys.

- Electric taxi

The same safe, reliable taxis but with electric engines.

Priority taxi

Priority taxiYour classic taxi, designed for faster pickups when every second counts for your business.

Frequently asked questions

How can I get started with FREENOW for Business?

1. A self-sign-up approach for companies with less than 50 employees.

2. A tailored approach for companies with more than 50 employees

How the self-sign-up approach works:

1) Create your free company account in minutes.

2) Complete your account setup with billing information, payment method and optional settings like travel policies or cost centres.

2) Invite your employees to your account.

3) Once they join, your employees book reliable, fast taxi rides from FREENOW mobile app. You'll get a company-wide view of trips, automated expensing, simplified payments, and one monthly invoice — all in one platform.

How the tailored approach works:

Contact us and we'll talk about how we can tailor our platform to best meet your company's needs.

What can I do with a free FREENOW for Business account?

Our free key features include:

✔️ Monthly trip statements for accounting & HR

✔️ SAP Concur & Amadeus cytric expense management tool Integrations

✔️ Payment options with a centralised company debit/credit card or employee cards

✔️ Reporting & travel dashboard with travel policies, cost centres and references

In which cities does FREENOW for Business operates?

Click here to see all European cities we operate.

Which payment methods does FREENOW for Business have?

Can we travel abroad with the same FREENOW business account?

Does FREENOW for Business offer monthly invoicing?

Does FREENOW for Business offer a payment with Amex BTA?

Which expense management tools does FREENOW for Business have an integration with?

Does FREENOW for Business have special ride types for business clients?

Taxi Business: Newer, more comfortable cars offering a luxurious experience, perfect for special occasions like meetings or a business dinner.

Taxi Priority: Faster and priority pick-up. Perfect when every second counts.

Taxi Green: Electric or hybrid taxi to experience a cleaner ride for our planet.

Can I create cost centres and references in FREENOW for Business platform?

Can I restrict or choose certain ride types or locations, or times for our employees?

Travel policies are optional settings for better control of your work trips.

There are five categories of travel policies:

‣ Budget: You can set a spending limit per business trip or get a notification after a business trip exceeds a certain amount.

‣ Travel times: Employees can use the business account whenever they want, or set a time frame (e.g. only during working hours).

‣ Services: Choose or restrict any type of vehicle (regular taxis or eco-taxis), multi-mobility services (eScooters, eBikes, and car sharing) or public transportation.

‣ Locations: You can restrict the geographical coverage radius of the trips.

‣ Payment methods: Set up payment methods via the company account or reimburse trips paid with employee cards.

What reports and insights does FREENOW for Business provide?

Does FREENOW for Business provide sustainability reporting?

Yes, we offer sustainability reporting with CO2 usage. Contact us to learn more about the details and how it works